After several years of volatility, Nigeria’s macroeconomic performance shows signs of stability with modest growth, easing inflation, stronger business activity, and expanding sectors beyond oil. These developments indicate that the Nigerian economy is moving toward a more durable path of growth by 2026, though deep structural challenges remain.

After a series of revisions and a major rebasing of Nigeria’s GDP figures to better capture the size and structure of the economy, official data show that Nigeria’s economy expanded by 3.13 percent in the first quarter of 2025 compared with the same period in 2024. This growth was led by the services sector, with industry also contributing positively, while agriculture experienced marginal expansion. The rebasing brought a more accurate reflection of sectors such as technology and telecommunications, revealing stronger economic activity than previously recorded.

Several credible projections now show a moderate but improving growth trajectory for the Nigerian economy through 2026. The International Monetary Fund raised its forecast for Nigeria’s economic growth in 2025 to around 3.9 percent, an upward revision that reflects reduced uncertainty and stronger activity in key sectors such as services.  Independent financial institutions are projecting similar growth for 2026, with estimates in the range of 3.6 percent to 4 percent GDP expansion driven by non-oil sectors, improving investor confidence, and stabilising monetary conditions.  A recent commentary from economist Bismarck Rewane suggests that Nigeria could enter 2026 on its strongest economic footing in more than a decade, anchored on these dynamics.

The World Bank’s Nigeria Development Update further supports a cautiously positive outlook. It highlights that macroeconomic gains on growth, easing inflation, and current account fundamentals are creating a firmer foundation for the medium term. The Bank projects Nigeria’s GDP growth to continue rising modestly beyond 2025, boosted by steady performance in services and industry and a gradual agricultural rebound as structural reforms take hold.

Inflation has been one of Nigeria’s most persistent challenges in recent years, eroding purchasing power and complicating monetary policy. After a period of exceptionally high inflation in 2024, partly driven by supply chain disruptions and adjustment costs following major policy shifts, headline inflation has begun to moderate. Some recent reports point to inflation retreating from peaks and business sentiment improving as the naira stabilises and price pressures ease. Experts have emphasised that disinflation must be sustained and inclusive to translate into real income gains for households.  Even so, international institutions differ on inflation projections. Some forecasts suggest inflation will ease further toward more manageable levels in the medium term, while others caution that structural factors may continue to exert upward pressure.

The transition in exchange rate policy and foreign exchange management has also contributed to more predictable conditions for trade and investment. A more unified and transparent foreign exchange system has helped stabilise the currency relative to prior years, which, combined with stronger reserves and easing supply constraints, supports external confidence.

Beyond headline GDP and inflation figures, business activity indicators offer important insights into economic momentum. Recent Purchasing Managers’ Index data show Nigeria outpacing other major African economies in terms of output and new business growth, signalling broad-based private sector expansion. This robust PMI reading reflects not only recovery in traditional sectors but also growth in emerging industries and services.

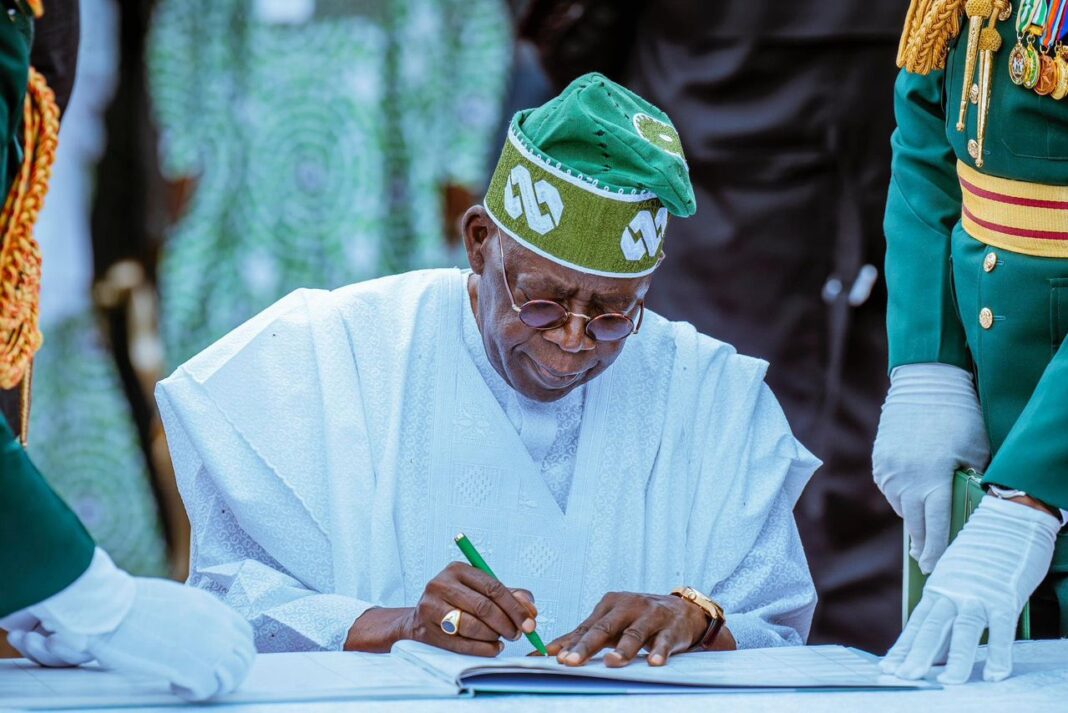

Structural reforms under the current administration, including the removal of fuel subsidies, exchange rate unification, and targeted tax reforms, have also played a role in stabilising Nigeria’s macroeconomic foundation. These reforms have reduced distortions, strengthened fiscal and monetary credibility, and encouraged more sustainable revenue generation outside oil. Fiscal discipline and revenue diversification remain critical, and analysts note that continued policy consistency is key to translating macroeconomic gains into broader prosperity.

At the same time, major challenges persist. The fiscal balance remains under strain, with projections indicating that the government may continue to run deficits as it balances spending with revenue growth. According to IMF data, Nigeria’s general government deficit is expected to remain elevated, requiring careful management of debt and public spending to avoid crowding out private investment.

Poverty and unemployment are other persistent issues that moderate the economic narrative. Although the economy is growing, the benefits have not yet translated proportionally into broad improvements in living standards for many Nigerians. Large segments of the population remain vulnerable to price shocks and labour market shifts, and sustained job creation remains a priority for inclusive economic progress.

Looking forward to 2026, the combination of steady growth, more predictable macroeconomic policy, stronger external position, and expanding business activity suggests that Nigeria is on a path toward more stable and resilient economic performance. Institutions are cautiously optimistic that the economy could enter 2026 on firmer footing than it has seen in years, driven by non-oil sector dynamism and improved investor confidence.

All the verified metrics indicate that Nigeria’s economy is gradually strengthening and positioned for modest improvement in 2026. Growth is stabilising at higher levels than recent years, business activity is expanding, inflation pressures show tentative signs of easing, and structural reforms are beginning to create space for diversified economic activity. These developments suggest that the Nigerian economy is not only recovering but potentially entering a new phase of more durable growth. In essence, Nigerians have every reason to be optimistic. The tide is turning, and with it, the giant of Africa takes its rightful place amongst the comity of nations.

Samuel Aina