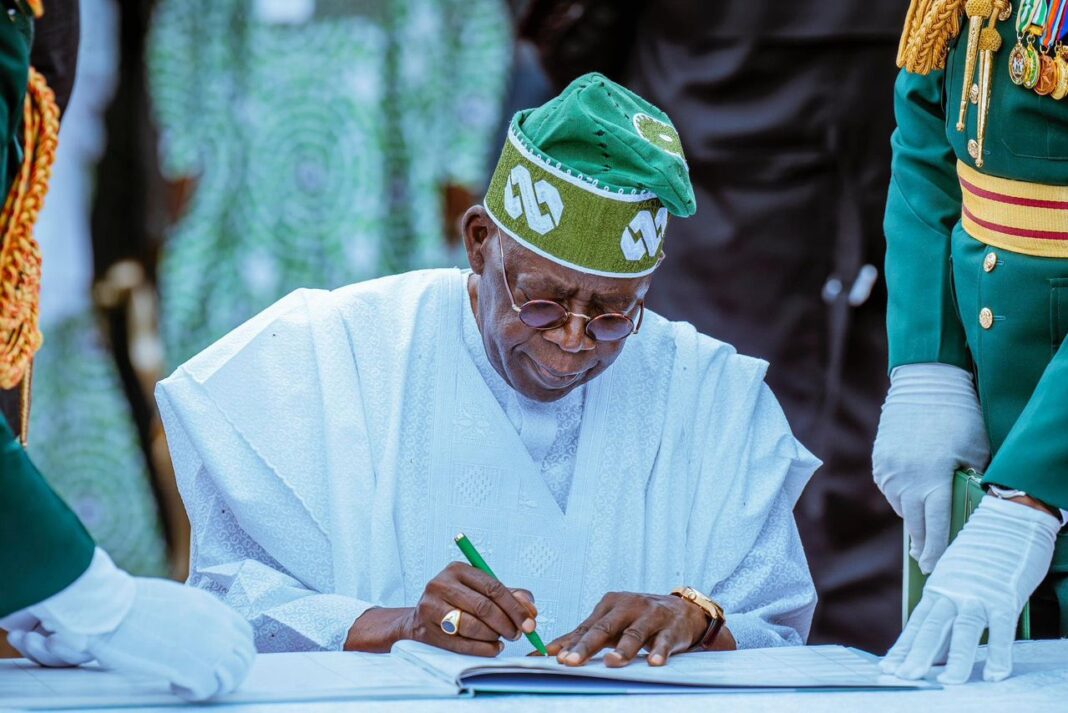

President Bola Tinubu has approved a 15 percent import duty on petrol and diesel imported into Nigeria, a policy move expected to reshape the nation’s downstream petroleum sector and protect local refining capacity. The approval, contained in a letter dated October 21, 2025, and signed by the President’s Private Secretary, Damilotun Aderemi, was addressed to the Federal Inland Revenue Service and the Nigerian Midstream and Downstream Petroleum Regulatory Authority. The new duty is to be applied to the cost, insurance, and freight value of all imported petrol and diesel shipments.

The move followed a recommendation by the Federal Inland Revenue Service, which argued that the measure would align fuel import pricing with domestic realities and strengthen the competitive position of locally refined products. Government sources said the decision was part of ongoing efforts to reduce Nigeria’s overreliance on fuel imports, stabilize the downstream market, and encourage investment in domestic refining infrastructure. The government maintained that the measure was not primarily aimed at generating additional revenue but was designed to promote fair market competition and support emerging local refiners.

Analysts say the import duty could push pump prices higher by between ₦100 and ₦150 per litre, depending on exchange rate and freight variables. They noted that the policy would increase the landing cost of imported fuel, giving local refiners such as the Dangote Refinery and rehabilitated state-owned plants a cost advantage in the domestic market. While the Dangote Refinery, with a capacity of 650,000 barrels per day, has already commenced production, the Nigerian National Petroleum Company Limited has intensified efforts to complete repairs and upgrades on the Port Harcourt, Warri, and Kaduna refineries to restore full operations.

However, some independent marketers and stakeholders have expressed concern that the duty could lead to higher costs for importers and ultimately worsen the hardship faced by Nigerians if the burden is transferred to consumers. An All Progressives Congress chieftain, Ayiri Emami, urged the President to reconsider the policy, warning that it could cause additional strain on households already struggling with the consequences of subsidy removal and rising living costs.

Despite these concerns, government officials defended the move as a necessary step toward energy independence and market stability. They argued that Nigeria’s heavy dependence on fuel imports was unsustainable, noting that the country spent about ₦4 trillion on fuel importation in the first half of 2025 alone — ₦1.76 trillion in the first quarter and ₦2.3 trillion in the second. They said the import duty would help reduce such spending over time by incentivizing local production and discouraging excessive importation.

Comparative data also show that Nigeria’s fuel prices, even with the new duty, would remain lower than those in neighboring West African countries such as Ghana, Senegal, and Côte d’Ivoire. Government insiders said this helped justify the decision from a regional market standpoint. The Nigerian Midstream and Downstream Petroleum Regulatory Authority is expected to issue detailed implementation guidelines. At the same time, the Federal Inland Revenue Service will monitor compliance to ensure imported fuel meets the new tariff requirements.

The success of the policy will depend on how quickly Nigeria’s refineries can meet domestic demand and how effectively regulators prevent anti-competitive practices that could distort the market. There are also concerns that importers may reduce supply to avoid losses, potentially creating temporary fuel shortages. Economists have warned that even a modest increase in pump prices could have ripple effects on transportation costs and inflation.

President Tinubu’s administration has continued to pursue reforms in the petroleum sector since the removal of fuel subsidy in 2023 and the subsequent implementation of the Petroleum Industry Act. The approval of the 15 percent import duty marks another major intervention aimed at restructuring the industry and positioning Nigeria for long-term energy security. While the policy promises to strengthen local refining capacity and conserve foreign exchange, it also presents new challenges for a population already grappling with high living costs. The coming months will reveal whether the new tariff achieves its intended goal of protecting domestic producers without worsening the economic strain on Nigerians.

Samuel Aina